Are Energy Markets Ready for 2025 Winter?

Every year, the energy market plays a familiar game: spend summer quietly filling up gas storage and brace for whatever winter throws our way. But 2025 isn’t quite following the usual script.

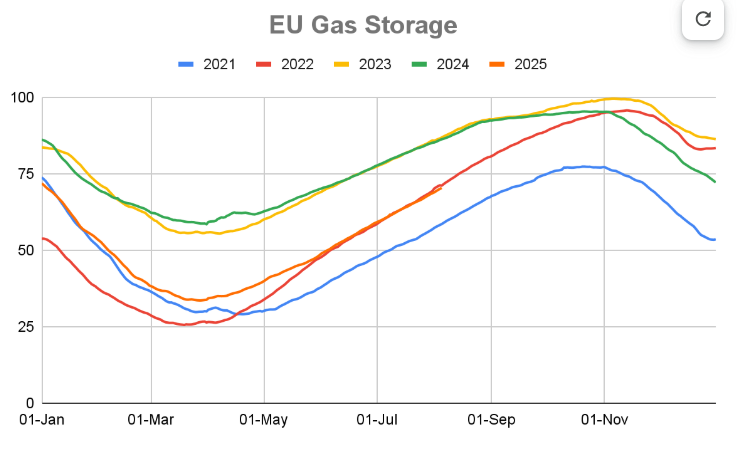

The past few months have seen whispers turning to warnings. Colder-than-average temperatures last winter pushed demand higher, which means we entered injection season already behind. Now, with summer nearing its end, storage levels across Europe are tracking noticeably below the 2023 and 2024 benchmarks—looking similar to 2022.

And we all remember 2022.

The energy crisis that year wasn’t just a wake-up call. It was a full-blown alarm, flashing red across every boardroom, trading desk and supply chain. Prices spiked, volatility surged, and the fragility of Europe’s gas infrastructure was laid bare. While politicians scrambled for emergency measures, businesses were left navigating price chaos and procurement paralysis.

So what’s different now? Why aren’t prices surging again? And let’s not sugar-coat it; are we genuinely ready for what could be another bruising winter?

*Data source: Gas Infrastructure Europe (GIE), AGSI, and ALSI.

Storage Isn’t Just a Safety Net. It’s Market Psychology.

First, let’s break down what gas storage actually does. Gas storage is not simply a reserve tank to tide us over during the colder months. It’s a fundamental driver of price stability, supply security, and, crucially, market sentiment.

Europe’s storage capacity acts like a pressure valve. When storage is high, the market breathes easier. There’s room to manoeuvre, flexibility in pricing, and reduced exposure to short-term shocks. But when storage is low, risk premiums creep back in. Price forecasts become more reactive, and suppliers start pulling every lever they’ve got to keep supply chains liquid and contracts stable.

The concern this year isn’t just about volume. It’s about trajectory. Storage levels aren’t building at the same pace as previous years, and the closer we get to the heating season, the harder it becomes to play catch-up. That’s when spot markets become more reactive, and when forward pricing reflects less confidence, not more.

What’s Propping Up Market Confidence in 2025?

Despite the bearish signals from storage, markets aren’t panicking. Wholesale prices have been relatively well-behaved through summer, and volatility is far more muted than in 2021 or 2022.

The reason is: Structural Adaptation

Post-2022, Europe got smarter, faster. LNG import capacity was ramped up aggressively. Flexibility in sourcing and diversification of supply routes took precedence over legacy pipeline dependence, especially on Russian gas. And the UK played a pivotal role here, acting as both an import terminal and a transit hub for LNG flows heading into mainland Europe.

In 2025, confidence is being buoyed by that structural shift. There’s a stronger reliance on LNG cargoes from the US, Qatar, and other producers, which provides options, even if it's more expensive at times.

But LNG is not a silver bullet.

It offers flexibility. It’s filling some gaps. But it’s still subject to geopolitical flashpoints, shipping constraints, and contractual bottlenecks. And with secondary sanctions on Russian LNG gaining political traction in the US, this could create greater competition for US and Qatari cargoes and, of course, increase the price.

In short: the market might feel stable right now, but we can’t confuse calm with certainty.

Norway’s Maintenance Season

Another factor worth watching closely is Norwegian gas output. As the most significant supplier of pipeline gas to Europe post-Russia, Norway has become the quiet backbone of regional supply. But every year, it undergoes routine field maintenance in late summer, typically August and September.

In most years, this maintenance is baked into the forecasts, with storage already at comfortable levels before those flows tighten. But not in 2025. We’re heading into that planned maintenance window with less in the tank, which increases the market’s sensitivity to any unplanned disruptions.

Throw in a cold snap or unexpected outage, and price signals may become more volatile.

Regulatory Buffers Help, But Don’t Eliminate Risk

It’s worth acknowledging that the European Commission did learn from 2022. Mandated gas storage targets were introduced, requiring member states to hit specific fill levels ahead of winter. Those targets helped bring a degree of predictability back into the system.

But in 2025, the rules are looser.

Countries have been given more flexibility in how and when they hit those mandated levels. It’s a pragmatic move, recognising national constraints and storage disparities, but it also dilutes the collective buffer. With some countries lagging behind, the overall EU picture is uneven.

So no, we’re not staring down the same barrel as 2022.

What does this mean for businesses?

If you’re in procurement, finance, or operations, this isn’t just a macroeconomic curiosity; a key early warning for decision makers. Storage levels affect winter wholesale prices, which impact hedging decisions, contract structures, and pass-through costs.

Locking in supply early can still make sense. But flexibility is king.

Smart businesses are avoiding rigid procurement cycles and instead looking at blended strategies: partial hedging, seasonal balancing, and short-term contract overlays that allow for more reactive posturing if market shocks emerge.

At Unify Energy, we don’t wait for winter to test the system - we help our customers build strategies that are ready year-round.

That starts with tailored contracts. Not rigid, one-size-fits-all templates, but flexible supply structures shaped by real-world usage patterns, risk appetite, and business priorities. Whether it’s fixing portions of load, incorporating pass-throughs, or building in trigger mechanisms, our contract models are built to respond, not freeze, when markets move.

But it’s not just contracts. More and more, customers can lean on us for energy consultation, asking us to model consumption scenarios, review their metering estate, or sense-check their in-house strategies. Because when you're dealing with tighter margins and unpredictable price swings, advice that’s grounded in market knowledge, trading insight, and operational feasibility isn’t a luxury, it’s a necessity.

We are a commercial energy supplier that combines consultation with full transparency, granular reporting, and visibility across fiscal and sub-metered data, so our customers know exactly where they stand and where they’re headed.

So, are markets ready for winter?

Structurally? More than they were. Psychologically? That’s debatable.

What matters now is execution - how businesses turn insight into action, and how quickly they adapt as the temperature drops and market dynamics shift.

We’re keeping our customers ahead of the curve, not just with better data, but with the clarity and flexibility to act on it. When others are reacting to volatility, our customers are already positioned.

Because readiness isn’t about guessing right. It’s about understanding, building in control, resilience, and transparency from day one.